Imagine a payroll system that operates so smoothly you barely need to think about it. You can savor your morning coffee, undisturbed by the tedious intricacies of managing employee payments. In this blog, we're going to explore a new and game-changing way to handle payroll that will completely change the way you think about it. We'll unveil the secrets of a system so streamlined and efficient that it has reduced late-night number crunching and tax compliance stress for a staggering 80% of companies. Moreover, this innovative approach has led to a remarkable 30% increase in overall workplace productivity.

But the real question is, how is this possible? What's driving this revolution in payroll management? Get ready to explore how smart payroll solutions and new technologies are simplifying complex processes, enhancing accuracy, and freeing up valuable time and are thereby making a big difference for businesses like yours.

What is an automated payroll?

Payroll automation is a modern solution that streamlines and simplifies the process of paying employees within an organization. It leverages specialized software to handle tasks such as calculating wages, taxes, deductions, and distributing payments automatically. This technology eliminates the need for manual intervention, reducing the likelihood of errors and ensuring that employees are compensated accurately and punctually.

With payroll automation, businesses can enhance efficiency, save time, and maintain compliance with tax and labor laws, ultimately allowing them to focus on core operations and growth. It's a crucial tool for managing payroll effectively in today's fast-paced business landscape, benefiting both employers and employees alike.

What are the benefits of an automated payroll?

An automated payroll offers a multitude of advantages that can transform the way you handle your workforce. Let's explore the exceptional benefits that make it an essential tool for today's businesses.

1. Error reduction

One of the standout advantages of automated payroll is its ability to significantly reduce errors. Manual payroll processing is prone to human mistakes, from miscalculations to data entry errors. According to the American Payroll Association, these errors can cost a company 1-8% of its total payroll expenses. That's a substantial figure that automated systems help to curb.

Consider this scenario: An employee's hours were incorrectly recorded, resulting in an underpayment. In a manual system, this might go unnoticed until the employee raises the issue. With automated payroll, such errors are minimized, ensuring that employees are accurately compensated every time.

2. Time savings

Time is a precious resource in any organization. Automated payroll liberates your HR and finance teams from the time-consuming burden of manual payroll processing. A study by the National Small Business Association found that small business owners spend an average of eight hours per month on payroll-related tasks. With automation, this time can be reallocated to more strategic activities.

For instance, instead of manually inputting data and processing checks, your HR team can focus on talent development and employee engagement initiatives, fostering a more productive and motivated workforce.

3. Enhanced compliance

Navigating the complex landscape of tax laws and labor regulations can be daunting. Non-compliance can result in hefty fines and legal complications. Automated payroll systems, however, help ensure that your organization stays on the right side of the law.

For example, these systems can automatically calculate and deduct the correct amount of taxes, reducing the risk of errors and potential penalties. Additionally, they can generate accurate and compliant reports for tax authorities, saving your organization from the hassle of audits and investigations.

4. Employee self-service

Empowering employees to access and manage their payroll information is another standout feature of automated systems. Through self-service portals, employees can view pay stubs, update personal information, and even access tax forms independently. This not only enhances employee satisfaction but also reduces the administrative workload on HR departments.

In conclusion, the benefits of automated payroll are clear and compelling. From error reduction and time savings to enhanced compliance and employee self-service, it's a tool that adds value to organizations of all sizes, freeing up valuable resources and reducing the headaches associated with manual payroll processing.

When is the right time to switch to an automated payroll?

The right time to switch to automated payroll is when you want to save time, money, and sanity while ensuring your team gets paid correctly and on time. The time to switch to automated payroll is now, and here's why:

- Growing pains: If your business is expanding, manual payroll becomes a real pain. Automated payroll can handle the growing complexities effortlessly, ensuring your team gets paid accurately and on time, no matter how many new faces join the company.

- Error eraser: Manual payroll means human errors—calculations gone wrong, misplaced decimal points, and data entry blunders. Automated payroll swoops in as the hero, eliminating these costly mistakes.

- Time saver: Don't spend hours on payroll paperwork. Automation frees up your valuable time, allowing you to concentrate on achieving strategic objectives and taking your business to new heights.

- No tax troubles: Taxes are a maze of rules and regulations. Automated systems are your GPS, guiding you safely through the tax landscape, ensuring you stay compliant, and avoiding penalties.

- Employee happiness: Happy employees make a happy workplace. Automated payroll ensures timely and accurate payments, boosting employee satisfaction. Happy employees are more productive employees.

- Scalability superpower: Your business is like a superhero ready to grow. Automated payroll can scale with you effortlessly, adapting to your needs, no matter how big you become.

- Data security shield: Protect sensitive payroll data like a fortress. Automated systems come with robust security features, keeping your information safe from prying eyes.

- No more late nights: Say goodbye to those late-night payroll crunch sessions. Automation makes payday a breeze, so you can enjoy your evenings stress-free.

- Audit-ready always: Keep those auditors at bay. Automated payroll systems maintain meticulous records, so you're always audit-ready.

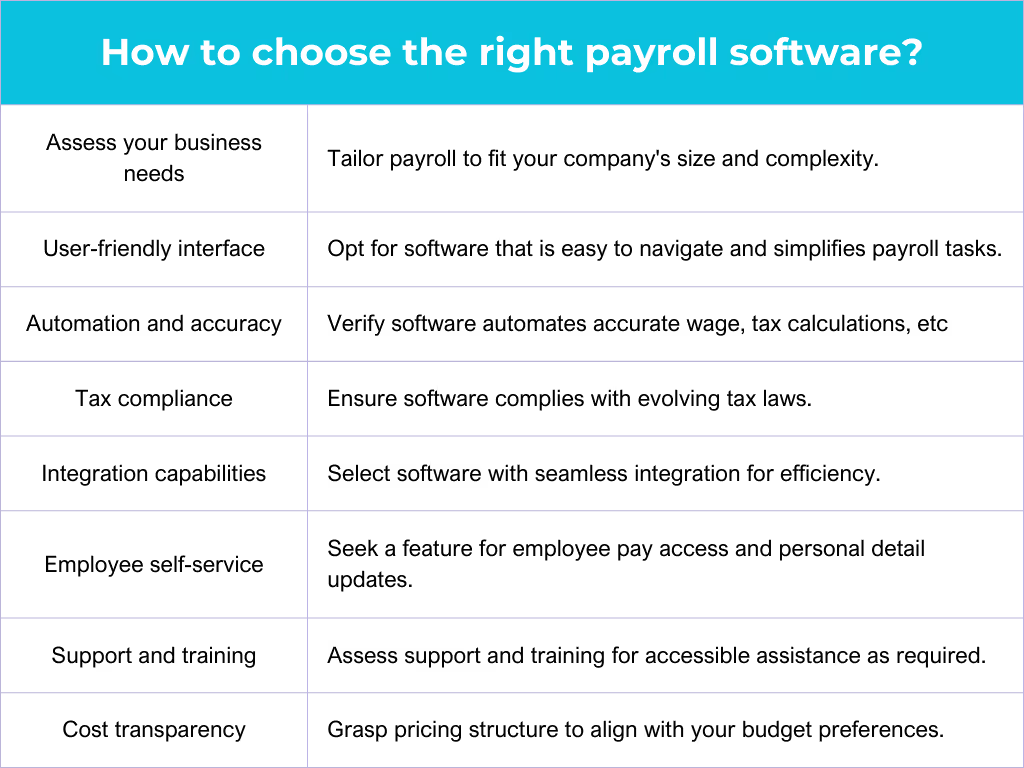

How to choose the right payroll software for your business?

Here are 8 things to consider while choosing the right payroll software for your business:

Common myths about automated payroll systems busted!

Automated payroll systems have transformed the way businesses manage payroll, making it more efficient and accurate. However, there are several misconceptions or myths surrounding automated payroll. Let's debunk these myths and shed light on the reality of this essential tool for modern businesses.

Myth 1: "It's too complicated to implement"

One of the most common myths about automated payroll is that it's a complicated and time-consuming process to set up. In reality, most modern payroll software is designed with user-friendliness in mind. They offer intuitive interfaces and easy-to-follow setup wizards that guide users through the process. Additionally, many providers offer dedicated customer support and training to assist with implementation. Automating payroll is often simpler and faster than people assume.

Myth 2: "It's only for large corporations"

Another misconception is that automated payroll is suitable only for large corporations with extensive HR departments. In truth, payroll automation is scalable and adaptable, making it a valuable asset for businesses of all sizes. Small and medium-sized businesses can benefit just as much as larger organizations. Automated systems are designed to accommodate the specific needs and complexities of different businesses.

Myth 3: "It's expensive"

Some believe that implementing automated payroll is cost-prohibitive for small businesses. While there may be initial setup costs and subscription fees, these expenses are often offset by long-term savings in time, and resources, and reduced errors. Payroll automation can help businesses save money by reducing costly payroll mistakes and streamlining processes.

Myth 4: "It replaces the human touch"

Automated payroll is sometimes wrongly assumed to eliminate the need for human involvement. In reality, automated systems enhance the efficiency of HR and finance teams by reducing manual data entry and calculations. They free up time that can be used for more strategic and human-centric aspects of HR, such as talent development and employee engagement.

Myth 5: "It's prone to errors"

Some worry that automated systems are prone to technical glitches and errors. While no system is entirely error-proof, modern automated payroll software is rigorously tested and updated regularly to ensure accuracy and compliance. Additionally, these systems reduce the risk of human errors associated with manual calculations and data entry.

Myth 6: "It's inflexible"

Another misconception is that automated payroll software is rigid and cannot accommodate unique business needs. In reality, many payroll software solutions offer customization options to tailor the system to a business's specific requirements. They can handle various pay structures, deductions, and compliance needs, providing flexibility to meet diverse business needs.

Myth 7: "It's not secure"

Security concerns can deter businesses from adopting automated payroll systems. However, reputable providers invest heavily in security measures to protect sensitive payroll data. These measures include encryption, access controls, and compliance with industry standards. Automated systems often offer better data security compared to manual processes that can be vulnerable to physical theft or mishandling of documents.

Myth 8: "It's only about paychecks"

Some believe that automated payroll is solely focused on issuing paychecks. In reality, these systems encompass a wide range of functions beyond payroll processing. They handle tax calculations, compliance reporting, employee self-service portals, and comprehensive record-keeping, making them a holistic solution for payroll management.

Conclusion: Why wait? Automate!

Automated payroll systems have made remarkable strides, shattering prevalent misconceptions that may have hindered businesses from embracing these indispensable tools. In truth, automated payroll is not only accessible but also remarkably flexible, cost-effective, and highly secure. It acts as a robust ally in bolstering precision, compliance, and the overall efficiency of payroll management, catering to businesses of varying sizes and complexities. Armed with accurate information, organizations can make informed decisions, recognizing the potential of automated payroll systems to revolutionize their payroll processes, streamline operations, and ultimately contribute to their growth and success.

FAQs

1. How do you make an automated payroll system?

Creating an automated payroll system involves these steps:

- Assess your needs: Identify your payroll requirements, including pay frequency and deductions

- Choose a payroll software: Select suitable payroll software based on your business size and needs

- Data collection and entry: Gather accurate employee information and input it into the software

- Configuration: Set up pay policies, tax rates, and deductions within the software

- Integration: Integrate with HR and time-tracking systems, if applicable

- Automation: Use the software to automate calculations for gross pay, deductions, and taxes

- Tax compliance and reporting: Ensure tax compliance and generate accurate reports for tax authorities

- Payment processing: Facilitate direct deposits or issue paychecks as needed

- Employee self-service: Enable employees to access pay information and update personal details

- Record-keeping: Maintain comprehensive records for auditing and reporting

- Security measures: Implement strong security protocols to protect sensitive data

- Scalability: Ensure the system can grow with your business and receive updates as needed

- Training and support: Train your teams to use the system and provide ongoing support

- Continuous monitoring: Regularly monitor system performance and seek opportunities for improvement

2. When is the right time to switch over to automated payroll?

The right time to switch to automated payroll is when manual payroll processes become time-consuming, error-prone, or overly complex due to business growth or changing needs. It's ideal to make the switch when the benefits of automation outweigh the costs and effort involved.

3. How to automate payroll?

To automate payroll, choose suitable payroll software, input employee data, set up pay policies and tax rates, integrate with relevant systems, and enable automation for calculations and payments. Regularly update the system and provide training to ensure smooth payroll automation.

4. What happens if there are payroll errors?

Payroll errors can result in financial losses, employee dissatisfaction, legal penalties, audits, and a loss of trust. They also burden HR and finance teams with administrative work, lead to tax complications, and can damage a company's reputation and employee turnover rates. To avoid these consequences, businesses should prioritize accuracy and compliance in their payroll processes.

5. How long does it take to set up an automated payroll?

The setup time depends on the complexity of your payroll needs and the chosen software. It can range from a few days to a few weeks. Some providers offer guided setups to expedite the process.

.png)